How smart publishers deal with the January CPM drop

(With inputs from Mary Brannen, Director of Revenue Operations at Blockthrough.)

“Whatever goes up, must come down.” In the publishing business, that axiom is most accurately reflected in how the value of CPMs cycles through the year.

Q4 is typically the most profitable quarter for publishers, with increased ad spend and heightened consumer activity during the holiday season. This is followed by a precipitous drop in CPMs in the first week of January, and then a gradual recovery through the year.

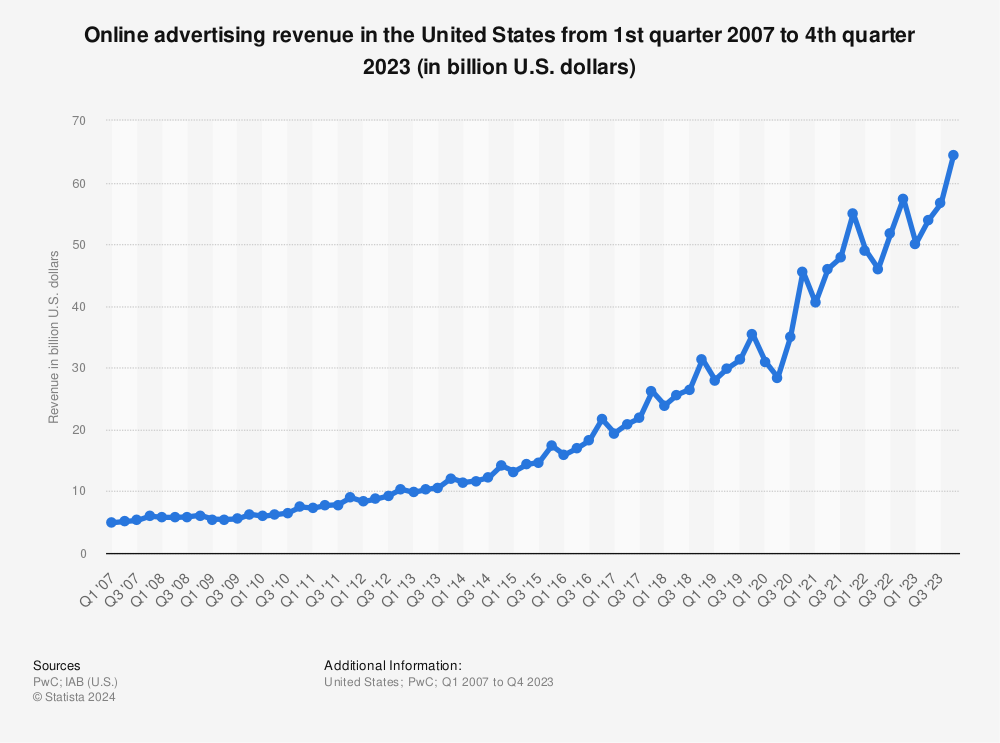

This chart by Statista shows the recurring drop in ad revenue at the beginning of every year.

Despite the fact that this happens every year, it can be alarming to watch the CPMs drop come January. In this post, we’ll look at why this happens and what savvy publishers do about it.

Understanding the problem

So, why does this happen? Here are a few reasons:

- Reduced ad spend: By the time January comes, most advertisers have already exhausted their annual budgets. Starting in Q1, they start planning the spend for the new year, which means that most of the campaigns running at the end of Q4 are effectively stopped.

- Drop in seasonal traffic: Retail publishers witness a spike in traffic towards the end of Q4, users are busy looking for discount deals, browsing gifting ideas, planning holidays. Other publishers get the benefits of this as people go into ‘holiday mode’. People take time off and spend more time on the internet… but in Q1, it is back into work mode.

- Lower fill rate: When you have a lot of advertisers competing for space on your ad inventory, you can afford to keep a high floor price and still maintain a healthy fill rate. During Q1, demand plummets, pushing fill rate down with it.

How to deal with the January CPM drop

While it is unlikely that any publisher can completely mitigate the revenue drop in January, there are tweaks and optimization opportunities related to content strategy, programmatic setup, and strategic partnerships that smart publishers employ to tide them over the slow period and create a launchpad for accelerated recovery as we proceed into the new year.

Here are some ideas:

Adjust your floor price

During periods of high demand, setting a high floor price can help publishers maximize yield by filtering out lower value bids. However, when demand is low, floor price can act as a barrier to entry for a much larger volume of bids—pushing down fill rate in the process.

Try reducing your floor price to match the current demand, either manually in small decrements or dynamically using the Target CPM feature in Google Ad Manager. Alternatively, you can disable price floors during the first week of January and gradually increase it as demand returns.

Experiment with ad refresh

Ad refresh allows publishers to display more than one set of ads to a user over the course of a single pageview. Google AdX supports ad refresh and GAM allows it, as long as the trigger interval is more than 30s and the refresh inventory has been declared. Many other exchanges also support refresh, but do check the policies to make sure it’s allowed, and under what conditions.

Using ad refresh can have a multiplier effect on the number of impressions generated, which is especially useful in low-traffic scenarios, though you should be careful about how you implement it, as a poorly configured refresh can devalue your inventory.

For best results, make sure your site has above-average session duration, as that is where refresh works best. Finally, do not refresh ads outside the viewport, doing this can negatively affect your viewability score, decreasing the value of your inventory.

Optimize ad layout for CTR and viewability

During peak revenue season, most publishers are reluctant to make any big changes. The first half of Q1 provides an opportunity to try some new things in a low-risk environment.

Start A/B testing your existing ad layout with a focus on improving clickthrough rates (CTR) and viewability scores. Even small positional changes can have a positive impact on CTR by counteracting the effects of banner blindness.

Viewability is another performance indicator that many advertisers use to determine inventory quality and how much they’re willing to bid for impressions. If you’re using lazy loading, make sure that ads are not loading outside the user’s viewport, as this can hurt your viewability score.

Consent management & page speed

This might be the time to implement a consent management platform (CMP) if you haven’t yet. CMPs can help publishers stay compliant with the latest online privacy regulations and also provide a revenue boost with the collection of opt-in consent for third-party targeting.

Another low-hanging fruit is optimization of your website to achieve good Core Web Vital scores. Since Google plans to start using them as a signal to rank pages next year, working to improve the scores in Q1 means that you will be reaping the benefits through the year.

Review your demand stack

Since the primary cause of the January CPM drop is reduced demand, it makes sense to add new demand right before Q1 begins. Doing this can increase competition for your inventory.

Publishers should try to bring unique demand to the table, such as niche SSPs and retargeters who don’t just resell demand from the open exchange, but provide access to Private Marketplace Deals (PMPs) and other value-added demand.

Capitalize on seasonal search trends

Another thing to note is even despite the drop in seasonal demand, advertisers are still running their ‘evergreen’ campaigns—ones that are relevant all year round. So if possible, work on making your existing content more appealing for your users and advertisers.

There are also opportunities based on what users are searching for. Here are some examples:

- January: Diet and exercise, gym memberships, New Year’s resolutions

- February: Valentine’s day, Superbowl

- March: Tax software for Americans

Creating focussed seasonal content can give you a traffic boost at the time of year when you need it most. Use Google Trends to identify similar search opportunities relevant to your niche.

Monetize your adblocked traffic

Most publishers have an adblock rate of anywhere between 10-40%, depending on niche, device split, traffic geo, existing CPM, and ad density. By engaging with their adblocked audience in a way that is respectful and based on choice, publishers can create a new channel of revenue that might help offset the revenue declines from the January CPM drop.

We recommend ad recovery using Acceptable Ads—which allows publishers to engage over 90% of their adblocked audience by showing them advertising that is respectful, non-intrusive, and relevant. Use our calculator to determine your recovery opportunity or get in touch with us.

Most importantly: Don’t panic

Seasonality is an expected phenomenon in ad tech that affects everyone, including publishers, advertisers, and vendors. The important thing is to stay calm and know that things will return to normal soon. And in that time, publishers should focus on testing, optimization, and laying the groundwork that is essential to having a successful year ahead.